Whether or not your goal is to travel around the world together like Kara and Nate, you’ll need 2x the points and miles to travel with your spouse — pretty straightforward. But how exactly do you double up on your rewards? Fortunately, it’s quite simple as well.

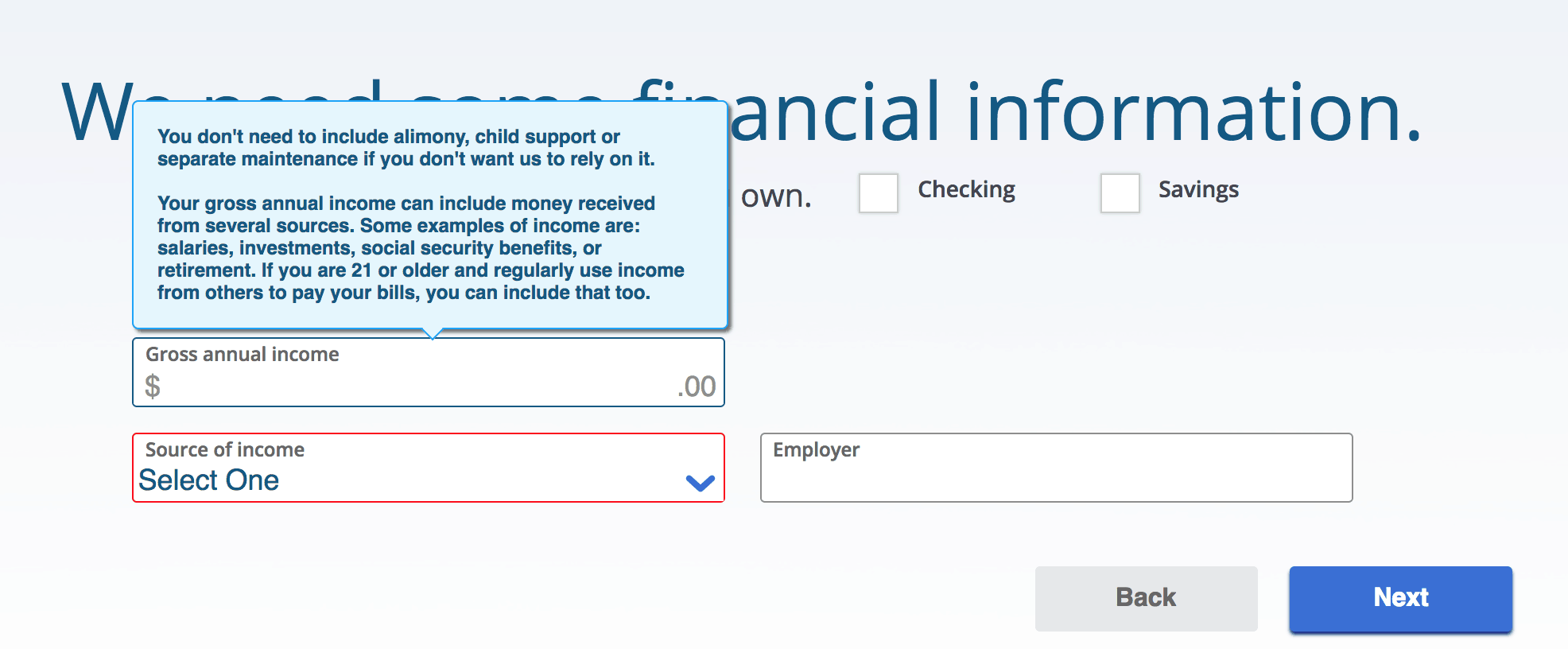

Contrary to common belief, individuals can (and should) apply for the same credit cards as their spouses. Banks don’t care whether you’re married or not when reviewing credit card applications. What they do care about is your personal credit history and income. Fortunately for non-working individuals, people 21 and older can include income from a spouse or partner on a credit card application, so long as you have a reasonable expectation of access to it.

For example, if your spouse makes $60,000 per year, and you have reasonable expectation of access to the money, you could report $60,000 on the “gross income” section of your application.

Now you’re probably asking yourself why you can’t just add your spouse as an authorized user and save a ton on annual fees. Well, you can, BUT you’ll miss out on valuable credit card welcome bonuses if you do that. Since welcome bonuses are never limited to once per household, you’ll want to maximize them and earn them as many times as you can.

Here’s how:

Step 1: Pick a card and have one person sign up — our monthly round-ups of the top offers would be a good starting point if you need help finding a card. The reason only one person is signing up at first is because cards have minimum spend requirements for their sign-up bonuses, and you want to make sure you’re actually reaching them.

Step 2: Meet the minimum spend requirement to receive the welcome bonus.

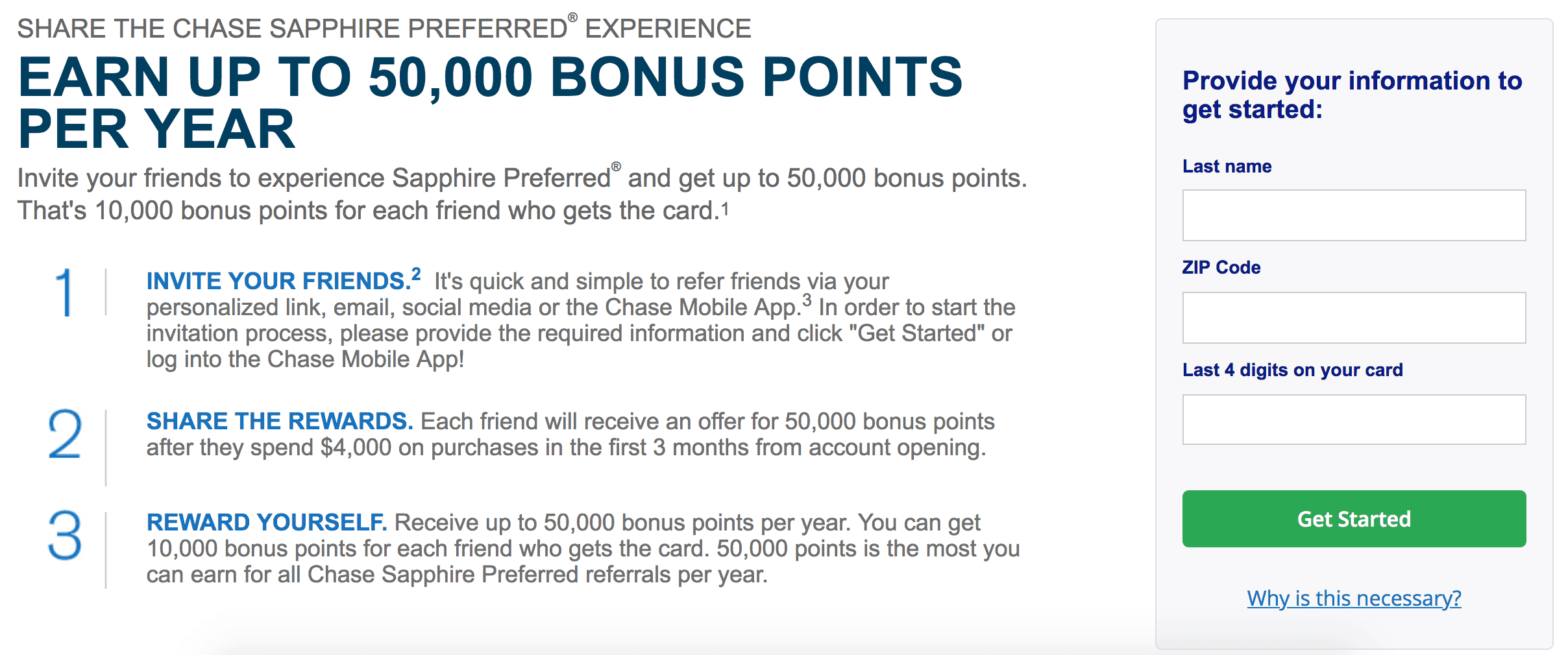

Step 3: “Refer” your spouse to the card and have them sign up using your referral link — some cards offer bonuses for referring people to the card, but not all. For example, if you signed up for the Chase Sapphire Preferred card and you referred your spouse, you could currently earn a 10,000 point referral bonus!

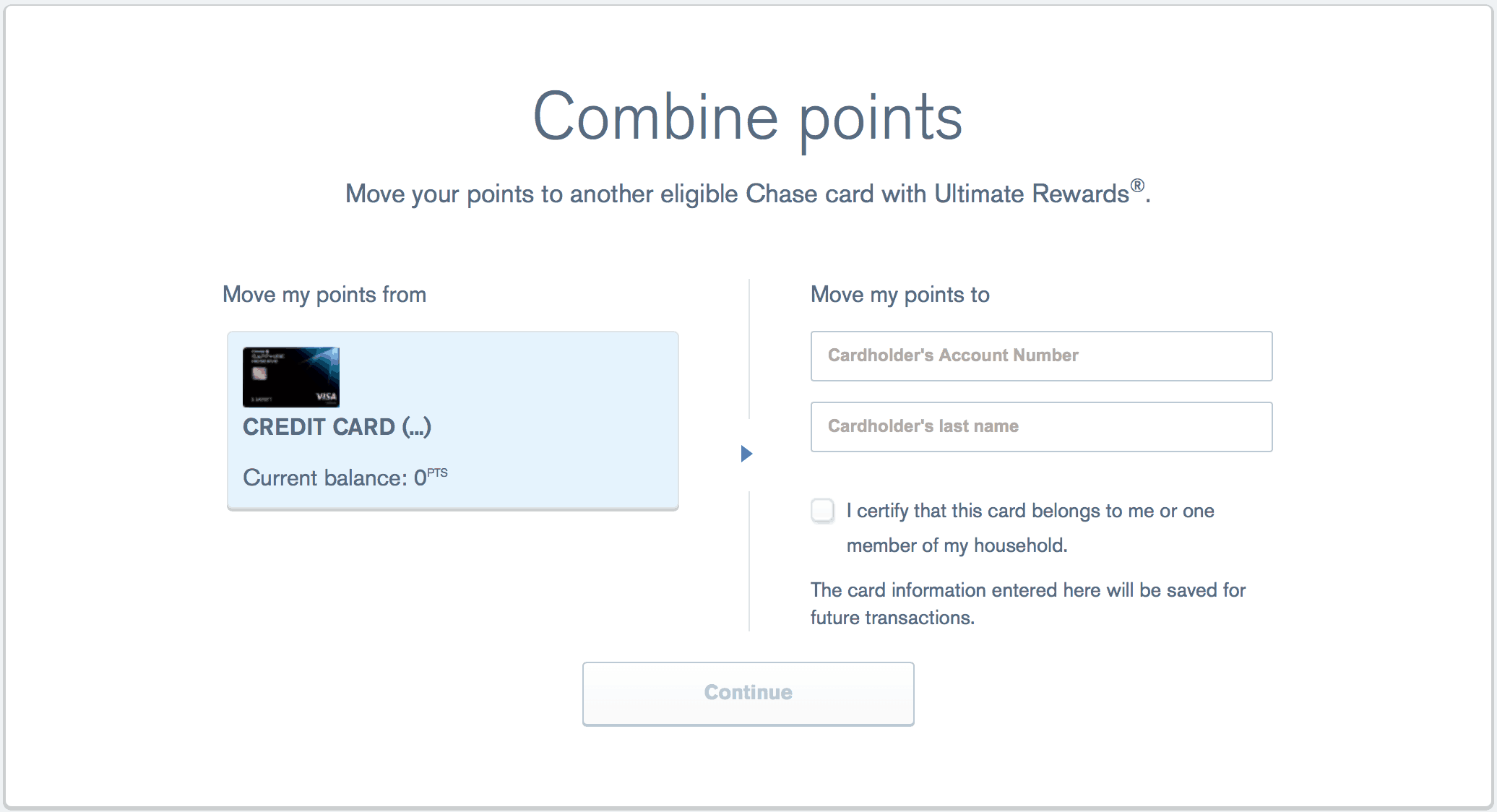

Step 4: Combine your points. While only one US airline (JetBlue) allows you to pool your points with other members of your family, credit card rewards programs are a bit more lenient. Programs which allow you to transfer points to another member of your household include Citi ThankYou Rewards, Chase Ultimate Rewards, and Starwood Preferred Guest. American Express Membership Rewards points cannot be transferred to another member’s Amex account, but there is a workaround. If you add your spouse as an authorized user on your account, you may transfer points to their frequent traveler programs, such as Delta SkyMiles.

Step 5 (optional): Once you’ve received the welcome bonus, it’s probably not worth it for both partners to continue paying the annual fee. At this point, it could be a good idea to downgrade one of the cards to another card from the same bank that doesn’t have an annual fee and add your spouse as an authorized user.

By doing this, you won’t need to pay a card’s annual fee twice and your spouse will be able to maintain benefits like their own Priority Pass membership for lounge access. You’ll want to stay away from canceling credit cards as that will most likely hurt your credit score.

By following these steps and tag-teaming on credit card offers with your spouse, you will earn double the rewards and be able to reach your travel goals quicker. Just remember to pay off all cards on time. Maintaining a spreadsheet with all of your and your spouse’s cards and important information like dates of when bills are due would be a great way to stay organized.

If you need help choosing a card for you and your spouse, we’d be more than happy to recommend a card (or two) for you! All you need to do is fill out this form.

[…] Nate’s Note: You could easily earn 90,000 American Airline miles by signing up for 2 credit cards. There are currently 2 credit cards offering generous welcome bonuses worth 50,000 and 40,000 points (more details here). Plus, these points could be earned even quicker if both Alec and his wife signed up for the cards separately. Click here to learn how couples can maximize their miles and points. […]