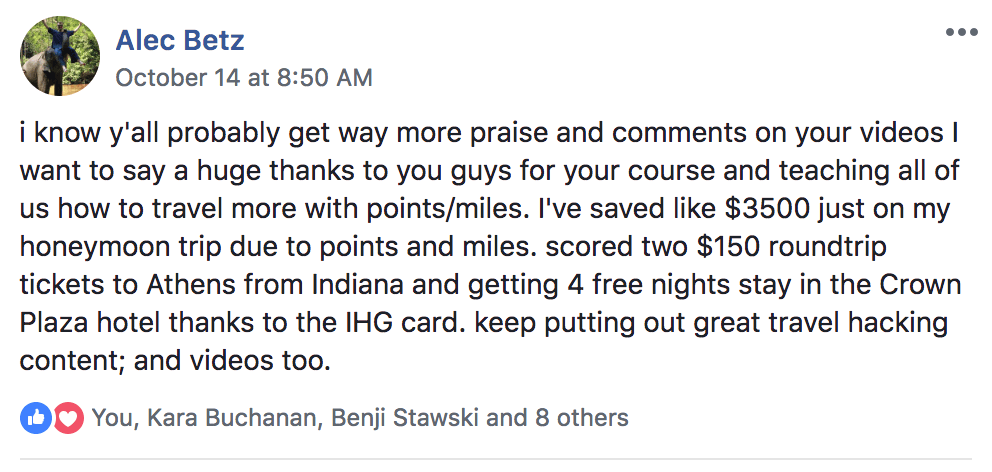

The miles and points we’ve collected from travel credit cards have easily saved us over $30,000+ in travel expenses, and they have enabled us to enjoy luxurious experiences like business class flights and luxury hotel stays that we otherwise wouldn’t have been able to afford.

We believe a good travel credit card (or a few) is a tool that all financially responsible travelers should be using. However, knowing which travel credit card(s) to apply for can be confusing.

Between restrictions like Chase’s 5/24 rule and some bonus offers only being available for a limited-time, it’s important to strategize the time and order in which you sign up for new credit cards. To help you prioritize your credit card sign-ups, we update this post every month to include what we believe are the top credit card offers on the market. Since we’re covering what we consider to be the best offers — not just limited time offers — some of the cards on this list may remain consistent from month to month.

If you still need help choosing a card after reading this post, we’d be more than happy to recommend a card (or two) for you! All you need to do is fill out this form.

Detailed Reviews

1. Chase Sapphire Preferred®

Current offer: 60,000 Ultimate Rewards points after spending $4,000 within the first three months.

Annual fee: $95

Why it’s great: The Chase Sapphire Preferred is one of my favorite cards! Ultimate Reward points are very valuable, given their flexibility and ability to use to make an award booking. The points are worth more when redeemed through the Chase Travel Portal, at 1.25 cents each. So your 60,000 bonus points are worth $750 in free travel! You can also transfer your points at a 1:1 ratio to the following airlines: United, Singapore, British Airways, Korean, Southwest, and Virgin Atlantic. Chase Sapphire Preferred is currently netting card holders 5x points on travel booked through Chase Ultimate Rewards, 3x points on dining, including eligible delivery services, 3x points on online grocery purchases (excluding Target, Walmart and wholesale clubs), 3x points on streaming services, and 2x points on all other travel spending.

Other benefits worth mentioning:

- No foreign transaction fees

- $50 credit on Ultimate Rewards Hotels annually

- Discounts on DoorDash with free DashPass subscription

- Car rental insurance

- Travel accident insurance

2. Capital One Venture X Rewards Credit Card

Current offer: A total of 75,000 bonus miles after spending $4,000 in the first 3 months.

Annual fee: $395

Why it’s great: At first glance the annual fee may seem expensive, but each year you receive a $300 travel credit that’s super easy to use. Plus, each year on your card anniversary, you’ll receive 10,000 bonus miles which are $100 in free travel. Those two perks alone cover the cost of the annual fee.

Plus, this card gives you free priority pass membership which gives you an unlimited number of visits to 1,300+ Priority Pass lounges worldwide.

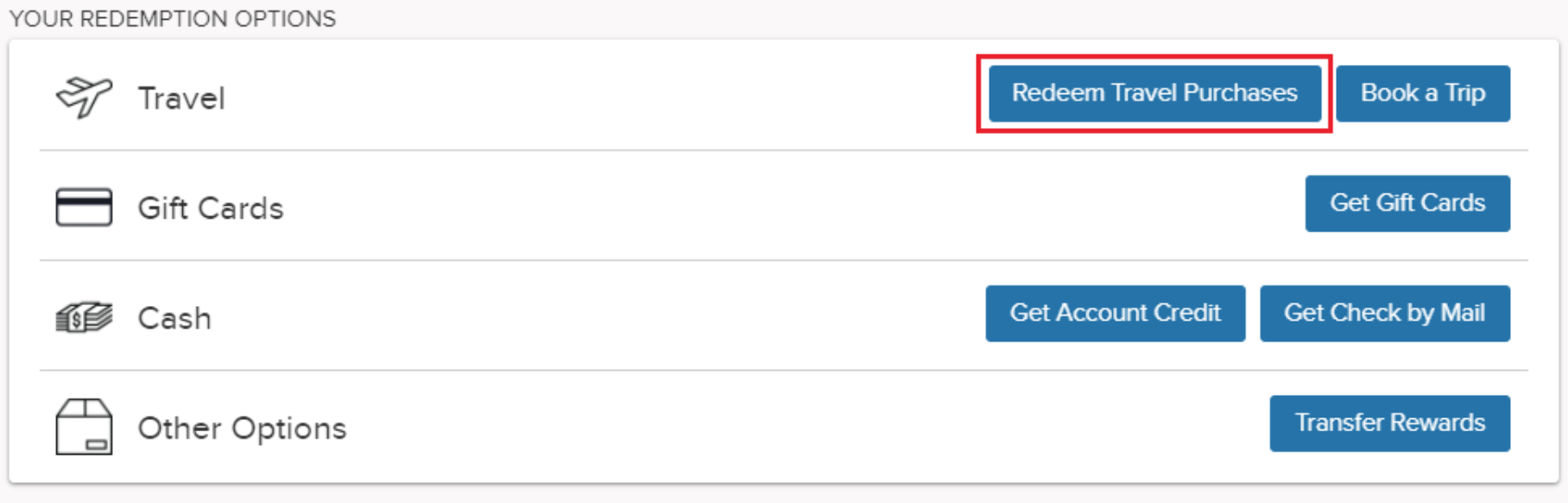

I’ve saved the best perk for last, and that’s the 75,000 bonus miles you’ll receive after meeting the minimum spend! Capital One Rewards allow users to book travel or cover travel booked in the previous 90 days for one cent per mile. That means this card is would cover $750 on travel, even retroactively! Capital One miles can also be transferred to a number of airline programs at a ratio of 1:1, allowing for true flexibility in booking the best reward flights.

Other benefits worth mentioning:

- No foreign transaction fees

- Receive $300 back annually as statement credits for bookings through Capital One Travel

- 10,000 mile anniversary bonus

- 10 Miles per dollar on hotels and rental cars booked through Capital One Travel

- 5 Miles per dollar on flights booked through Capital One Travel

- 2 Miles per dollar on every purchase, every day

3. Chase Sapphire Reserve®

Current offer: 60,000 Ultimate Rewards points after spending $4,000 within the first three months.

Annual fee: $550

Why it’s great: The incredible travel rewards earned from this card more than make up for the high annual fee. One of the best perks is the $300 travel annual credit. Our favorite reward from this card is the free Priority Pass membership that gets the card holder and up to 2 guests free access to over 1,000+ airline lounges around the world! If you’ve ever watched our Youtube videos, you know we put this benefit to use almost every time we fly. This is a service we would gladly pay $250 for every year!

*** Chase Bank only allows you to sign up for one Sapphire card, so you have to choose between the Sapphire Preferred (mentioned below) and the Sapphire Reserve (this card).

Other benefits worth mentioning:

- No foreign transaction fees

- 3x points on travel and dining purchases

- 10x points on Lyft rides (through March 31, 2025)

- Discounts on DoorDash with free DashPass subscription

- Up to $100 application credit for Global Entry, NEXUS, or TSA Pre-check

- Lost luggage reimbursement

- Car rental insurance

- Travel accident insurance

4. The Platinum Card® from American Express

Current offer: 80,000 Membership Rewards points after spending $8,000 within the first six months.

Annual fee: $695

Why it’s great: The American Express Platinum Card offers some of the best perks available. The welcome bonus offer of 80,000 points is an excellent value, and the $695 is completely offset by spending credits. This card also offers 5x points on flights booked directly with airlines or with American Express Travel up to $500,000 per calendar year and 5x points on prepaid hotels booked with American Express Travel. Of course, our favorite benefit from this card has to be entrance to the American Express Global Lounge Collection, which includes access to the Centurion Lounge. Terms and restrictions apply to these fantastic benefits.

Other benefits worth mentioning:

- No foreign transaction fees

- $200 credit for airline incidental fees, after enrollment

- $200 credit on select hotel spending (which requires a minimum two-night stay)

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card(R) on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber

Cash and Uber VIP status is available to Basic Card Member only. Terms Apply. - $300 credit for Equinox spending, after enrollment

- $189 CLEAR® Plus Credit (subject to auto-renewal)

- Global Entry spending credit, after enrollment

5. Capital One Venture Rewards Credit Card

Current offer: A total of 75,000 bonus miles after spending $4,000 in the first three months

Annual fee: $95

Why it’s great: Capital One Rewards allow users to book travel or cover travel booked in the previous 90 days for one cent per mile. That means this card is would cover over $750 on travel, even retroactively! Capital One miles can also be transferred to a number of airline programs at a ratio of 1:1, allowing for true flexibility in booking the best reward flights.

Other benefits worth mentioning:

- $100 rebate on Global Entry/TSA PreCheck application fees

- 2x the miles on all spending

- 5 Miles per dollar on hotels and rental cars booked through Capital One Travel

- No foreign transaction fees

6. American Express® Gold Card

Current offer: 60,000 Membership Rewards points after spending $6,000 in the first six months on eligible purchases

Annual fee: $250

Why it’s great: The American Express Gold card has great earning potential, including 4X Membership Rewards® Points at Restaurants, plus takeout and delivery in the U.S., 4X Membership Rewards® Points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1x, and 3X Membership Rewards® Points on flights booked directly with airlines or on amextravel.com. Term Apply.

*For rates and fees, please visit Rates and Fees

Other benefits worth mentioning:

- $120 in dining credits, $10 per month, the Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- $120 Uber Cash: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- No foreign transaction fees

7. British Airways Visa Signature® Card

Current offer: 75,000 bonus miles after you spend $5,000 on purchases within the first 3 months of account opening. For a limited time you’ll also get 5x Avios up to $10k is gas, groceries, and dinners for the first 12 months.

Annual fee: $95

Why it’s great: You can get so much value from of British Airways Avios if you learn how to strategically redeem them using British Airways’ distance based award chart. For example, if you wanted to fly from Nashville to Dallas on American Airlines (a Oneworld partner), you would only need to pay 9,000 Avios each way. So with the 75,000 Avios you’d earn from the sign-up bonus, you could fly from Nashville to Dallas 10 times!

Other benefits worth mentioning:

- No foreign transaction fees

- Earn a companion ticket after spending $30,000 in a calendar year

- 10% off British Airways flights starting in the US

- Lost luggage reimbursement

- Car rental insurance

- Travel accident insurance

- Trip cancelation insurance

8. United Club℠ Infinite Card

Current offer: Earn 80,000 bonus miles after you spend $5,000 on purchases in the first 3 months from account opening.

Annual fee: $525

Why it’s great: We love the United MileagePlus program because the points are valuable and the awards are a breeze to redeem. This card is a great opportunity to earn a cache of United points, as well as to earn 4x the points on United spending and 2x on all other travel, restaurant and delivery spending. This card also includes a membership to the United Club, allowing you lounge access any time you fly.

Other benefits worth mentioning:

- Up to $100 rebate on Global Entry, NEXUS, or TSA PreCheck application fees

- Get 25% back on in-flight purchases

- No foreign transaction fees

9. United℠ Explorer Card

Current offer: Earn 60,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

Annual fee: $95 after your first year

Why it’s great: This card is offering 60,000 miles as a welcome bonus after spending $3,000 in the first three months. This card will earn double the miles on spending on United, restaurants and hotels. It also comes with many valuable perks for those that fly United often, including two one-time passes to the United Club, your first checked bag free and priority boarding.

Other benefits worth mentioning:

- Up to $100 rebate on Global Entry, NEXUS, or TSA PreCheck application fees

- Get 25% back on in-flight purchases

- No foreign transaction fees

10. IHG One Rewards Premier Credit Card

Current offer: Earn 140,000 bonus points after spending $3,000 on purchases in the first 3 months from account

Annual fee: $99

Why it’s great: This card has a hefty bonus given its low annual fee. This is a great card to focus on for booking award hotel stays. This also comes with automatic Platinum elite status, plus an annual award night worth up to 40,000 points. You’ll also always get your fourth night free when you redeem points for stays of four or more nights.

Other benefits worth mentioning:

- Earn up to 26 points total per $1 spent when you stay at an IHG hotel.

- Earn 5 points per $1 spent on purchases on travel, gas stations, and restaurants.

- Earn 3 points per $1 spent on all other purchases.

- Up to $100 rebate on Global Entry, NEXUS, or TSA PreCheck application fees

- No foreign transaction fees

That wraps up our review of the top personal travel credit card offers for this month. If you found this post useful, we’d be super grateful if you used our links to start your next credit card application!

Cheers,

Nate (and Kara)

For rates and fees of the American Express Gold card, please visit Rates and Fees.

For rates and fees of the Platinum Card from American Express, please visit Rates and Fees.

For rates and fees of the Capital One Venture X Card, please visit Rates and Fees.

For rates and fees of the IHG One Rewards Premier Credit Card, please visit Rates and Fees.